Pine Street Capital Partners Announces Final Closing of PSCP IV

Pine Street Capital Partners Announces Final Closing of PSCP IV

September 2024

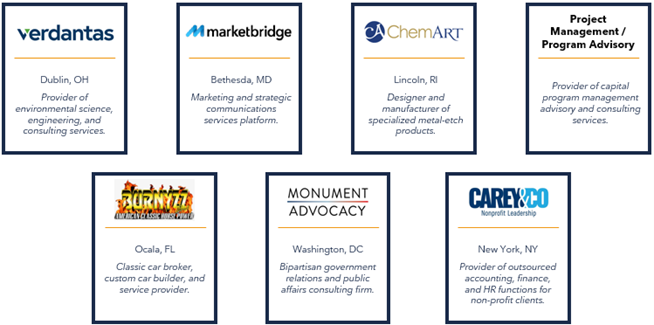

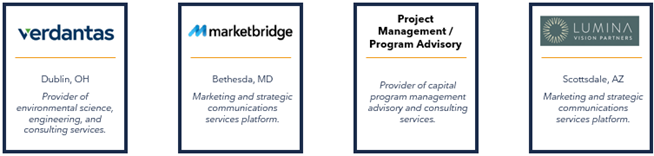

Pine Street Capital Partners (“PSCP”) is pleased to announce the successful final closing of Pine Street Capital Partners IV, LP (“PSCP IV”) at $203 million, exceeding our target amount. PSCP greatly appreciates the broad support from our existing limited partners, several new institutional and individual investors, and the U.S. Small Business Administration (“SBA”). PSCP IV continues our strong partnership with the SBA with the receipt of our third Small Business Investment Company (“SBIC”) license. With the closing of PSCP IV, Pine Street Capital Partners has raised more than $425 million since inception, investing in over 60 platform companies to date.

We currently have a strong pipeline of opportunities and are actively seeking new investments that meet our criteria.

We are committed to responding quickly to opportunities in a thoughtful and transparent manner.

Read more …Pine Street Capital Partners Announces Final Closing of PSCP IV

- Hits: 5526